maryland student loan tax credit status

Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Learn How The Student Loan Interest Deduction Works

Otherwise recipients may have to repay the credit.

. 15 to apply for a Student Loan Debt Relief Tax. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Complete the Student Loan Debt Relief Tax Credit application. To qualify to receive the debt relief tax credit applicants need to have been eligible for in-state tuition and graduated from a university or college in Maryland.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. More than 40000 Marylanders have benefited from the tax credit since it. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept.

August 31 2022 1121 AM. August 24 2022. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is arriving in just over two weeks. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Credit for the repayment of eligible student loans.

Maryland r esidents looking to claim student loan debt relief must do so in less than two weeks. Marylanders are eligible of they file their taxes have incurred at least 20000 in student loan debt and have at least 5000 in outstanding student loan debt. Eligible people have until Sept.

Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the. The Homestead Credit limits the increase. The state is offering up to 1000 in tax credits for student loan.

To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. If the credit is more than the taxes you would otherwise owe you will receive a.

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

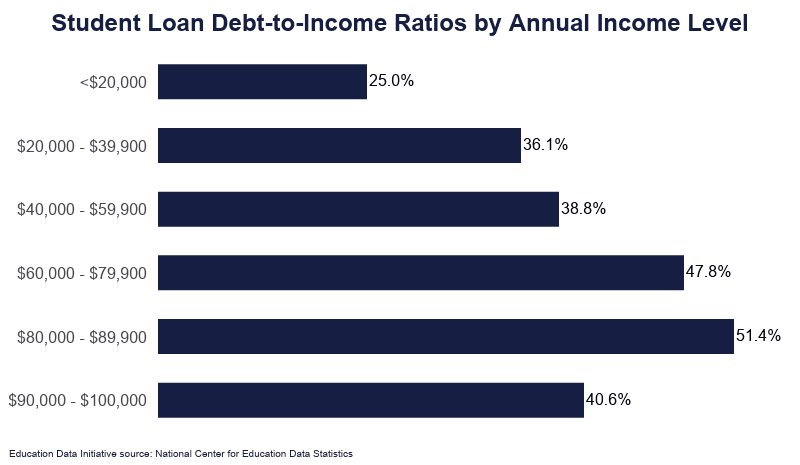

Student Loan Debt By Income Level 2022 Data Analysis

Maryland Student Loans Debt Statistics Student Loan Hero

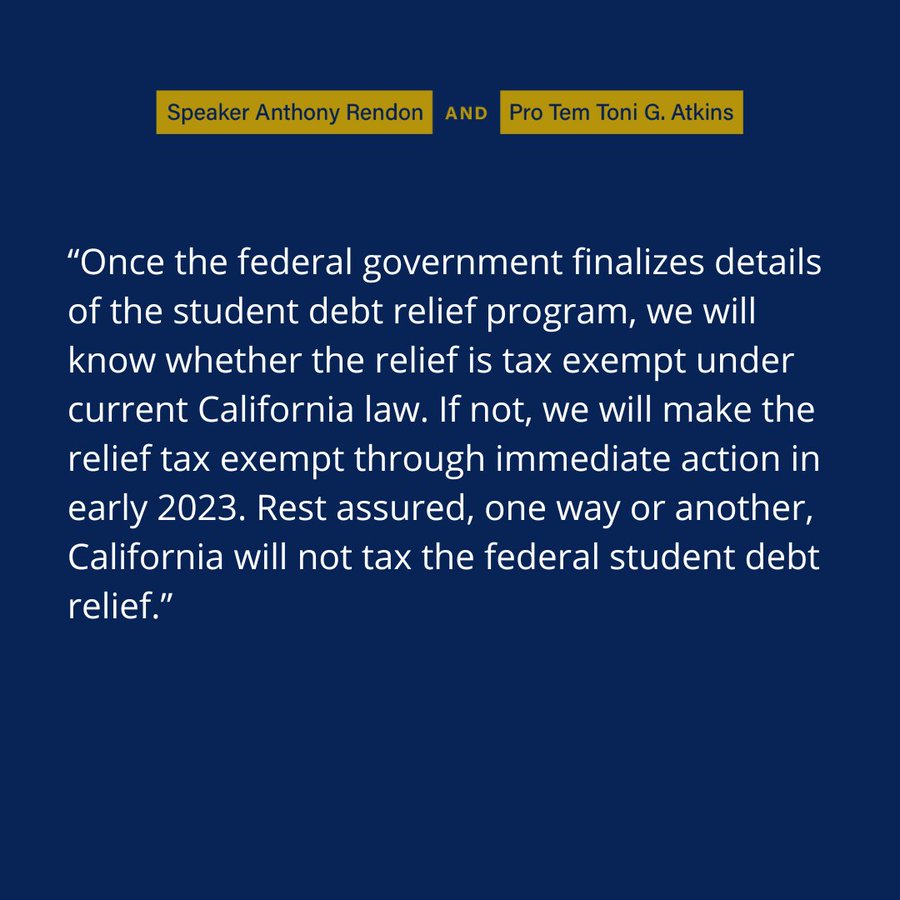

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Maryland Taxpayers May Qualify For Student Loan Debt Relief Tax Credit

Filing Maryland State Taxes Things To Know Credit Karma

How To Apply For Maryland S Student Loan Debt Relief Tax Credit Central Scholarship

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

What Is Maryland Student Loan Debt Relief Tax Credit Statanalytica

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Chart Where U S Student Debt Is Highest Lowest Statista

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Is Student Loan Interest Tax Deductible Rapidtax

Cares Act Gives Tax Break For Student Loan Employee Benefits Money

Maryland Student Loan Forgiveness Programs Student Loan Planner

Maryland Student Loan Tax Credit Tiktok Search

State Conformity To Cares Act American Rescue Plan Tax Foundation

Quick Guide Maryland Student Loan Debt Relief Tax Credit

Tax Credit Applications For Maryland Student Loan Debt Relief Close Thursday